This post may contain affiliate links, please read our disclosure policy.

Parenting is full of lessons that we need to teach our children, and saving money for their future is a big one. These 5 Tips On How To Teach Teens To Save Money will help you and your teen on the road to financial success. While this post is sponsored, all opinions are my own.

5 Tips On How To Teach Teens To Save Money

As a parent of a teenager who thinks that in a few years he can just walk into a car dealership and buy a new Ford Raptor, my husband and I have been trying to explain the importance of saving money a lot lately.

When I was a kid, I would be so excited when I found a quarter on the sidewalk because that meant I could go up to the corner store and get a popsicle. I understood that I needed money in my hand to buy something. I had my first job at 14 years old, and I saved just about every penny I made. At 16 I bought my first car for $500 and with the help of my dad we cleaned it up and sold it for $1000. I put that profit into the bank and saved it for college.

I feel like nowadays kids would walk past that quarter on the sidewalk because they don’t see the “value” in it. I will openly admit that my kids have everything they and more, and when we walk into a store and they “need” something, I end up buying it. And most of the time I am buying it with my debit card, so they never actually “see” the cash transaction. There is something to be said for the actual “cash transaction,” going from having money in your hand to having none. There is a lesson to be learned there, a lesson to be valued, a valuable lesson that we have to start teaching our kids.

As parents we have to teach our children that they need to grow up to be financially stable adults.

As National Teach Your Child to Save Day rolls around, now is the perfect time to start teaching best practices for saving. And with the graduating class of 2020 about to walk the stage and get ready for college, it’s urgent that parents make sure their teens have the information they need to manage their money. We want them to be able to take care of us one day, right? 😉

Of course, before we can expect kids to happily start saving their money, they might need our help understanding a few things to make it all make sense.

Here are 5 Tips On How To Teach Teens To Save Money:

- Help Them Create a Budget

While you may have encouraged your kids to save money for big purchases, many teens still don’t understand all the “whys” behind saving. They’ve never had to pay for things such as unexpected car repairs or monthly expenses like a utility bill.

TRY THIS: If your teen isn’t working or doing chores already, get them started right away…like TODAY — and begin paying for some personal expenses, such as gas and weekend entertainment. I have my son help with cutting the grass and both kids are responsible for the dishwasher and helping with laundry. Work together to create a budget of monthly income and anticipated expenditures to help create a clear picture of “money in” and “money out.” If your child is headed off to college, discuss which living expenses he or she will be expected to cover and how to accomplish that. This will help them get a better understanding of the value of money.

- Open a Bank Account If They Haven’t Yet

Before teens can truly master money matters, they should understand how money moves around. They need a solid rundown on the basics, from checking and savings accounts to bank fees, to how debit cards work and what it means to “bounce” a check.

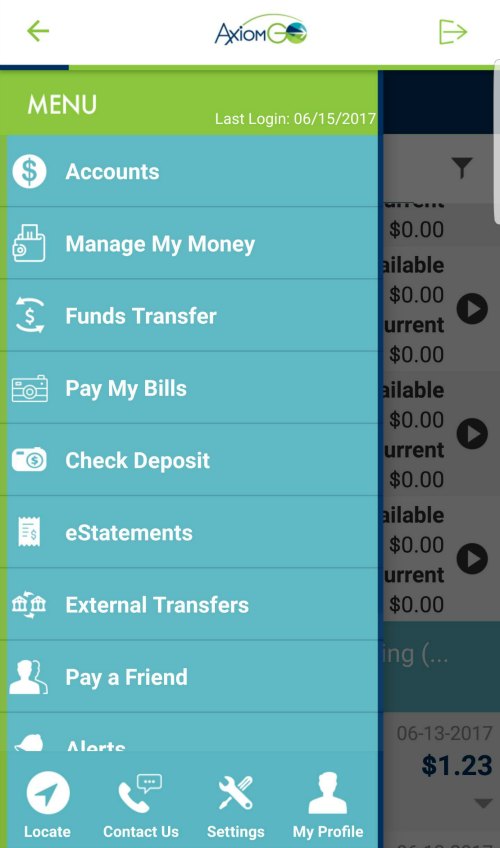

TRY THIS: Start off by opening a “checkless” checking account for your teen. One of the biggest bonuses of these types of accounts is that you can’t overdraft, which is good news when your child is still learning the financial ropes. Axiom Bank’s AxiomGO checkless checking app also lets you safely transfer money to your child’s account without visiting a bank branch, track expenditures, set up budget categories and more.

- Direct Deposit To Savings

“Pay yourself first” by automatically routing money into a savings account before allotting funds for other expenses. Regular, consistent contributions are key to building short-term savings (new car, vacation, etc.) as well as a rainy-day fund and a “nest egg” for the future.

TRY THIS: Help your teen open both short-term and long-term savings accounts. If he or she has a steady paycheck, sign up for direct deposit and then schedule automatic payday transfers from checking into each savings account. My $ Manager, AxiomGO integrated budgeting tool, lets you create budget and set savings goals and spending limits.

- Show How Credit Cards Work

It’s important that teens understand how borrowing money works, especially since they’re on the cusp of becoming credit-holders themselves. I remember the first credit card that I applied for when I was in college, I did it just so I could get the free candy bar they were handing out! I never even thought about what having a credit card meant. Building a credit history is important for financial success in adulthood. But with 4 out of 5 Americans in debt, your child needs to be aware of the potential pitfalls of credit. Help them understand that racking up too much debt or making late payments can result in huge interest payments and late fees that will damage their credit score — as well as their ability to borrow money in the future. You know, for when that want that fancy Ford Raptor 😉

TRY THIS: This Credit Card Simulator game helps teach teens what to look for when applying for a credit card, such as Annual Percentage Rate (and “introductory” APR) and annual fees. It also demonstrates how interest kicks in when you only pay the monthly minimum. And this credit calculator provides a visualization of how people with lower credit scores pay more in interest when they borrow money for big purchases such as houses and cars.

- Explain the Concept Of Interest

Your kids may not realize that “smart” saving is more than just sticking cash in a jar on a shelf. Which is exactly what my son does!! That’s why we must explain the idea of compound interest to them: When you save, you earn money on the funds you’ve stashed away. Just don’t forget to stress that the reverse is also true: When you borrow money, you pay money on the money you’ve been loaned.

TRY THIS: Use an online calculator to show how money saved will grow exponentially with various interest rates. One way to make the idea of interest more real to teens is for you to make contributions to their savings as they reach their goals.

Being a parent is one of the hardest jobs in the world, we are responsible for our kids becoming responsible adults. We have the ability to help our kids shape their future, and to do that, we have to teach them about the value of money and the importance of saving it.

AxiomGO is the perfect tool to help you finally achieve your financial goals and help teach teens o save money and to better understand the importance of saving for the future. AxiomGO is a mobile-banking app that will help you and your teens become a better money manager.

What is one of your tips on how to teach teens to save money?

Learn more about Axiom Banking by following on Facebook, Twitter, and by following their blog.

While you are at it, to find Food Wine Sunshine on Facebook, Twitter, Pinterest, for more helpful tips and healthy recipes. And be sure to follow me on Instagram.

Axiom Bank N.A, a nationally chartered community bank headquartered in Central Florida, provides retail banking services, including checking, savings, money market and CD accounts, as well as commercial banking, treasury management services and commercial loans for both real estate and business purposes.

We started our daughter young. My daughter returns the recycles the cans and bottles at the grocery store, and deposits her change at the bank right inside the grocery store.

That is a great way to help kids to save! And recycle 🙂

These are great tips, thank you for sharing, it is good to teach kids to save at a younger age so it will be instilled in them when making financial choices when they are older, I will have to remember these for when my kids are older!

~xo Sheree

poshclassymom.com

I agree completely! Lesson learned now will last forever 🙂

This is just great to read! Thank you for your passion about helping kids with financial skills. When I was younger, I didn’t have anyone to teach me financial stuff. The book that helped me was, Rich Dad Poor Dad. This is also a good site: http://www.Preparemykid.com

Thank you for sharing Estelle!